Are you passionate about finance and helping others achieve their financial goals? Becoming a Certified Financial Planner (CFP) could be the perfect career path for you. In this guide, we’ll discuss the steps you need to take to become a CFP and excel in the field of financial planning.

Educational Requirements

The first step to becoming a CFP is to obtain a bachelor’s degree from an accredited institution. While the degree can be in any field, it is recommended to major in finance, economics, accounting, or a related field to gain a solid foundation in financial principles.

After obtaining a bachelor’s degree, candidates must complete a CFP Board-registered program, which covers topics such as retirement planning, investment management, tax planning, and estate planning. These programs are designed to prepare candidates for the CFP exam and provide the necessary knowledge and skills to succeed as a financial planner.

Work Experience

In addition to completing the educational requirements, candidates must also gain relevant work experience in the field of financial planning. This can be achieved through internships, entry-level positions at financial firms, or working as a financial analyst.

Most CFP candidates are required to have at least three years of full-time work experience in the financial planning industry before they can sit for the CFP exam. This experience allows candidates to apply their knowledge in a real-world setting and gain practical skills that are essential for success as a CFP.

CFP Exam

Once the educational requirements and work experience have been fulfilled, candidates are eligible to sit for the CFP exam. The exam is a comprehensive assessment of a candidate’s knowledge and skills in financial planning and consists of multiple-choice questions, case studies, and client scenarios.

It is important for candidates to dedicate ample time to study and prepare for the exam, as passing it is a requirement for becoming a CFP. Many candidates choose to enroll in exam prep courses or study groups to enhance their chances of success.

Ethics and Continuing Education

After passing the CFP exam, candidates must adhere to the CFP Board’s Code of Ethics and Standards of Conduct. This code outlines the ethical responsibilities of certified financial planners and ensures that they act in the best interests of their clients at all times.

Additionally, CFPs are required to complete continuing education courses to stay current on industry trends and maintain their certification. This ongoing education ensures that CFPs are equipped with the latest knowledge and skills to provide top-notch financial planning services to their clients.

Career Opportunities

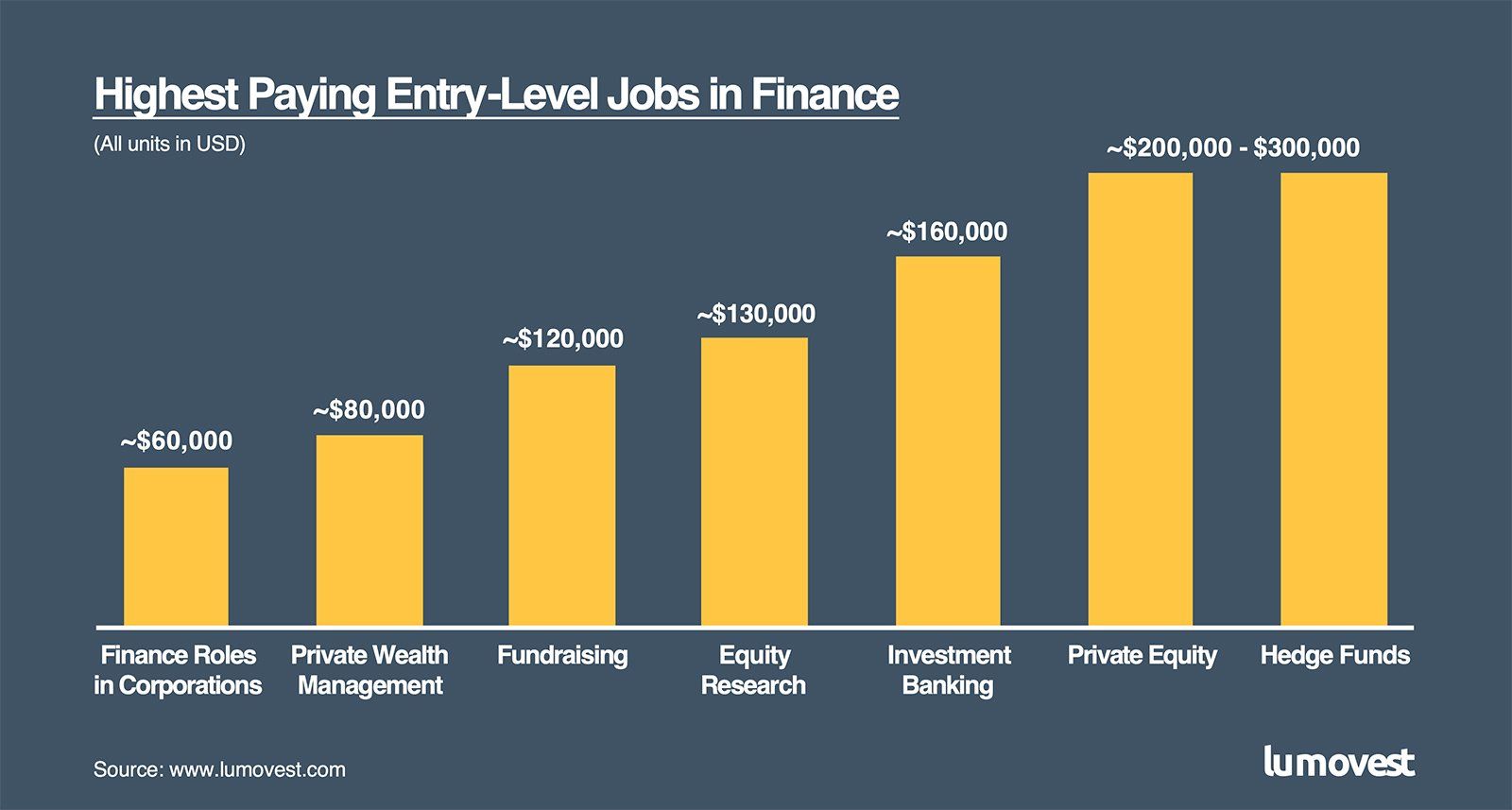

Upon becoming a Certified Financial Planner, individuals have a wide range of career opportunities available to them. CFPs can work as independent financial advisors, wealth managers, financial analysts, or consultants for financial institutions and corporations.

Many CFPs choose to start their own financial planning firms and build a client base of individuals and families seeking professional financial guidance. The demand for skilled financial planners continues to grow, making it an excellent career choice for those looking to make a positive impact on others’ financial futures.

Conclusion

Becoming a Certified Financial Planner requires dedication, hard work, and a passion for helping others achieve their financial goals. By completing the educational requirements, gaining relevant work experience, passing the CFP exam, and adhering to ethical standards, individuals can excel in the field of financial planning and make a lasting impact on their clients’ lives.